Chairman Emeritus Kushal Pal Singh offloads shares worth Rs 731 crore in DLF

Promoter and Chairman Emeritus Kushal Pal Singh has offloaded his entire shareholding of 1.45 crore shares worth ₹731 crore in DLF via open market transactions on Tuesday. The total promoter and promoter group’s shareholding in the real estate company was 74.95% as of June 2023. Singh’s shareholding was equivalent to 0.59% of paid-up equity.

On August 1, Chairman Emeritus Kushal Pal Singh, a prominent figure in the real estate sector, executed a significant financial move by divesting his entire personal stake in DLF, the largest real estate developer in India. This noteworthy development unfolded through a series of open market transactions, signifying a significant shift in Singh’s financial portfolio.

Kushal Pal Singh’s decision to offload his complete personal holding in DLF carries substantial implications, both within the context of his individual financial strategy and in the broader landscape of India’s real estate sector. The move underscores his strategic approach to managing his assets and underscores his assessment of the prevailing dynamics within the real estate market.

The open market transactions, which formed the vehicle for this divestment, reflect the intricacies of financial transactions conducted within a dynamic market environment. These transactions involve the buying and selling of securities, such as stocks, in the open market, with the value and timing of these trades influenced by a multitude of factors, including prevailing market conditions, investor sentiment, and the strategic goals of the individual or entity involved.

Kushal Pal Singh’s divestment of his personal stake in DLF holds significance beyond the financial realm. As a Chairman Emeritus, Singh’s association with DLF is deeply entwined with the company’s history and trajectory. His decision to part ways with his stake in the organization speaks to a broader evolution, both in his personal financial strategy and in DLF’s ongoing journey as a major player in India’s real estate sector.

The timing of this transaction is noteworthy, occurring as it does within the dynamic landscape of India’s real estate market. The broader economic and regulatory factors that shape the industry have undoubtedly played a role in shaping Singh’s decision. This divestment has the potential to influence market perceptions, potentially affecting investor sentiment and the perception of DLF’s future prospects.

The implications of this move extend beyond the individual players involved. Kushal Pal Singh’s stature in the real estate sector and DLF’s position as a market leader ensure that such financial decisions reverberate throughout the industry.

As stakeholders and market observers analyze the ramifications of this transaction, it serves as a tangible example of the interconnected nature of financial markets and the far-reaching impact of strategic decisions within this complex ecosystem.

In conclusion, Kushal Pal Singh’s decision to divest his entire personal holding in DLF through open market transactions on August 1 is a significant event with multifaceted implications.

Beyond its financial aspects, this move highlights the broader considerations that shape decision-making within the real estate sector and underscores the intricate interplay between individual financial strategies, market dynamics, and the evolving trajectories of major industry players. As the real estate landscape continues to evolve, this transaction stands as a marker of the ongoing transformation within one of India’s critical economic sectors.

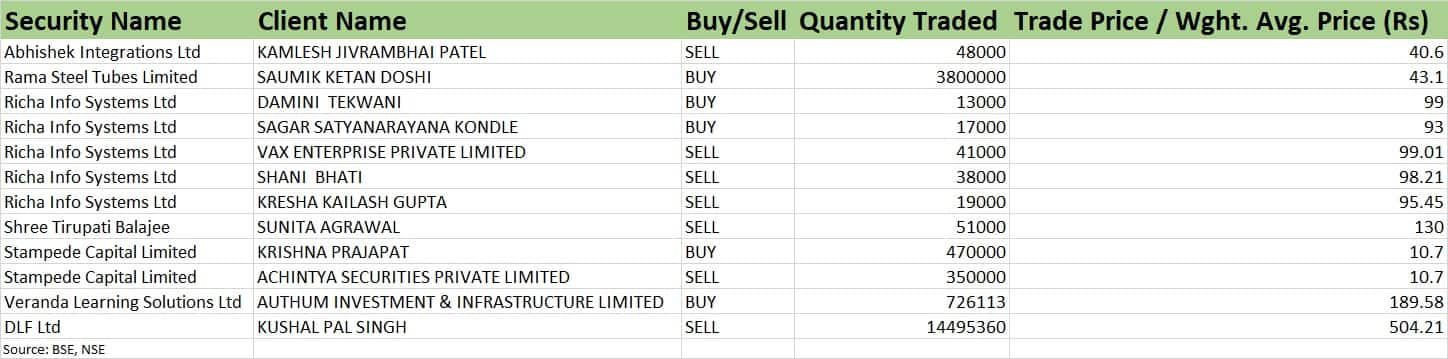

According to data from bulk deals, Kushal Pal Singh, the former chairman of the company, has engaged in a significant sell-off of shares. The transaction involves the sale of 1.45 crore shares, which translates to approximately 0.59 percent of the total paid-up equity, through the Bombay Stock Exchange (BSE).

This noteworthy bulk deal provides insight into the scale of Singh’s divestment and its impact on the ownership structure of the company. By shedding a substantial number of shares, Singh’s move could potentially lead to shifts in ownership percentages and influence the overall shareholder composition of the company.

Bulk deals of this nature offer a glimpse into the trading activity of major shareholders and institutional investors, revealing key trends and actions within the stock market. In this case, the data highlights Kushal Pal Singh’s decision to part ways with a considerable portion of his stake in the company, reflecting a significant shift in his investment strategy or personal financial goals.

The sale of 1.45 crore shares underscores the magnitude of this transaction and signals a strategic move on Singh’s part. As a former chairman of the company, his actions are likely to attract attention and scrutiny from investors, analysts, and market observers, all of whom will be interested in understanding the motivations and potential implications of this divestment.

The decision to execute this bulk deal on the Bombay Stock Exchange also holds significance. The BSE is one of India’s premier stock exchanges and plays a pivotal role in facilitating the trading of equities and other financial instruments. By conducting the transaction on this platform, Singh’s actions are made visible to a wide range of market participants, contributing to the broader market narrative and potentially influencing investor sentiment.

As the details of this bulk deal become known to the investing community, they will likely prompt discussions and analysis about the motivations behind Singh’s decision. This transaction serves as a testament to the ever-evolving nature of the stock market, where individual decisions by major shareholders can have far-reaching implications on the market dynamics, ownership structure, and overall sentiment.

In summary, the bulk deal data reveals that Kushal Pal Singh, the former chairman of the company, has sold 1.45 crore shares equivalent to 0.59 percent of the paid-up equity on the BSE.

This significant transaction provides a window into Singh’s strategic investment decisions, shedding light on his current financial objectives and potentially influencing the broader landscape of ownership within the company. As the market reacts to this development, it underscores the intricate interplay between individual actions and the broader dynamics of the stock market.

The recently divested shares, which were transacted at an average price of Rs 504.21 per share, held a total value of approximately Rs 730.87 crore. This substantial amount illustrates the significant financial impact of the sale, not only for Kushal Pal Singh but also for the overall ownership landscape of the company.

DLF, the country’s largest real estate developer, commands a total market capitalization of Rs 1.24 lakh crore. This valuation provides context to the scale of the company’s presence in the market and its standing among investors and industry peers.

Prior to the recent sale, Kushal Pal Singh and his affiliated group collectively held a significant share of 74.95 percent in the real estate company. This robust ownership percentage exemplifies the level of influence and control that Singh and his associates held within the organization as of June 2023.

The divestment of such a substantial number of shares, equating to 0.59 percent of the paid-up equity, prompts discussions about potential shifts in ownership dynamics. While Kushal Pal Singh’s ownership remains significant, this divestment could potentially alter the distribution of ownership percentages among other shareholders, institutional investors, and stakeholders within the company.

It is noteworthy that Singh’s decision to divest a portion of his holdings comes at an average share price of Rs 504.21. This price point underscores the valuation at which these shares were traded, reflecting the prevailing market conditions and investor sentiment at the time of the transaction.

As market participants analyze this development, considerations may include the reasons behind Singh’s decision to divest at this particular juncture, potential implications for DLF’s ownership structure, and broader implications for the real estate sector and the financial markets as a whole.

The dynamic nature of the stock market means that transactions of this magnitude are closely monitored and scrutinized, as they offer insights into the strategies and motivations of major shareholders and their impact on the overall market landscape.

In conclusion, Kushal Pal Singh’s divestment of a significant portion of shares in DLF, valued at Rs 730.87 crore and sold at an average price of Rs 504.21 per share, reflects a notable development in the company’s ownership landscape.

With a market capitalization of Rs 1.24 lakh crore and Singh’s group holding 74.95 percent of shares as of June 2023, this divestment introduces new considerations for market participants, prompting discussions about ownership dynamics and potential implications for both DLF and the broader financial market.

On the National Stock Exchange (NSE), DLF’s share price concluded at Rs 499.70, marking a decline of 3.7 percent. This movement was accompanied by higher trading volumes, indicating heightened market activity and investor interest. Notably, the share price found support at the 21-day Exponential Moving Average (EMA), positioned at Rs 499. This technical analysis metric suggests that the share price’s movement has been influenced by this moving average, potentially indicating a level of stability or a point of reference for traders and investors.

In a separate development, DLF reported robust financial performance for the quarter ending June FY23. Despite facing challenges related to weak operating margins, the company achieved a notable year-on-year growth of 12.2 percent in its consolidated profit, amounting to Rs 528 crore. This positive performance was primarily attributed to multiple factors, including a reduction in finance costs and other expenses. Additionally, DLF benefited from an increase in other income, further contributing to its improved profit figures.

The growth in profit, despite challenges in operating margins, reflects DLF’s ability to effectively manage its financial operations and capitalize on opportunities within its business environment. The decrease in finance costs and other expenses indicates prudent financial management, while the rise in other income underscores the company’s diverse revenue streams.

DLF’s financial performance is likely to attract attention from investors, analysts, and industry experts, as it showcases the company’s resilience and strategic decision-making. The ability to achieve growth amidst challenging conditions speaks to DLF’s competitive position within the real estate sector and its capacity to navigate market fluctuations.

As market participants evaluate DLF’s performance and share price movement, considerations may include the impact of macroeconomic factors, industry trends, and the company’s operational strategies. Furthermore, the interaction between technical analysis indicators, such as the 21-day EMA, and fundamental factors will be of interest to those monitoring DLF’s market performance.

The dynamics of DLF’s share price movement, in conjunction with its financial results, provide a comprehensive view of the company’s performance, its responsiveness to market conditions, and its potential for sustainable growth. Investors and stakeholders will likely continue to assess DLF’s future outlook based on these insights and developments in the real estate sector.

DLF reported a 1.3 percent year-on-year decline in revenue from operations on a consolidated basis for the quarter, amounting to Rs 1,423.2 crore. This reduction in revenue reflects a challenging operating environment or specific market conditions that impacted the company’s top-line performance during the given period.

Despite the decline in revenue, DLF demonstrated strong new sales bookings, recording Rs 2,040 crore in new sales during the quarter. This metric suggests that the company was successful in generating significant sales volume, potentially indicating a positive demand for its real estate offerings.

However, DLF’s operating numbers exhibited weakness in the reported period. The company’s Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) experienced a year-on-year decrease of 4.2 percent, amounting to Rs 396.2 crore. Additionally, the EBITDA margin declined by 90 basis points (bps) to 27.8 percent in Q1FY24. This indicates that DLF faced challenges in managing its operating costs or that its profitability was impacted by various factors.

The decrease in EBITDA and margin points towards potential challenges in managing expenses, maintaining profitability, or optimizing operational efficiency. These factors could be linked to market dynamics, changes in demand, cost fluctuations, or specific industry challenges.

DLF’s financial performance, encompassing both revenue and operating metrics, offers insights into the company’s overall health and operational effectiveness. While new sales bookings signal demand for its real estate offerings, the decline in EBITDA and margin highlights areas that may require attention and strategic adjustments.

The company’s ability to address these challenges and leverage its strengths will play a crucial role in shaping its future performance. Investors and industry observers will closely monitor how DLF navigates these dynamics, implements strategic initiatives, and capitalizes on growth opportunities within the real estate sector.

As DLF seeks to optimize its financial results and strengthen its position in the market, it may adopt various strategies to enhance revenue generation, control costs, and drive operational excellence. The interaction between these strategies and market conditions will ultimately determine DLF’s ability to achieve sustainable growth and maintain a competitive edge within the industry.

DLF remains committed to enhancing its financial position by concentrating on bolstering its balance sheet and generating cash flow. The company’s strategic efforts in this direction have yielded positive results, as evidenced by its recent financial update. The focus on strong collections, which refers to the timely collection of payments from customers or clients, has contributed significantly to DLF’s progress.

One notable outcome of these efforts is the substantial reduction in net debt during the reported quarter. This reduction in net debt is a clear indicator of DLF’s successful management of its financial obligations and liabilities. As a result of these initiatives, the company has achieved a historically low level of net debt, with the current figure standing at just Rs 57 crore.

The achievement of the lowest-ever net debt is a significant milestone for DLF and underscores its commitment to sound financial management and responsible business practices. By effectively managing its debt and improving its cash position, the company is better positioned to navigate potential challenges and seize opportunities for growth.

The reduction in net debt is likely a result of efficient financial management, successful operational strategies, and prudent capital allocation. These efforts have not only enhanced the company’s financial stability but have also positively impacted its overall financial health.

As DLF continues to focus on strengthening its balance sheet and cash generation, it can potentially unlock further value and create a solid foundation for sustained growth. By maintaining a disciplined approach to debt management and capital allocation, DLF can enhance its financial flexibility, support its business initiatives, and create value for its stakeholders.

The company’s commitment to reducing net debt and achieving its lowest-ever level reflects a strategic mindset aimed at fortifying its financial resilience and creating a more robust platform for future endeavors. As market conditions evolve and the real estate landscape continues to change, DLF’s efforts to optimize its financial position will play a crucial role in determining its ability to thrive and succeed in a dynamic business environment.

DLF Cyber City Developers, a prominent commercial properties developer and the flagship entity of the DLF Group, has demonstrated strong financial performance in the June quarter of FY24. The company’s financial results showcase notable growth across key indicators, reflecting its resilience and strategic focus.

One of the standout achievements for DLF Cyber City Developers is the significant year-on-year growth in its profit, which reached Rs 391 crore. This impressive 21 percent increase in profit underscores the company’s ability to effectively manage its operations and capitalize on market opportunities.

In addition to robust profit growth, DLF Cyber City Developers also reported a noteworthy expansion in its consolidated revenue. The company’s consolidated revenue for the quarter amounted to Rs 1,412 crore, marking a commendable year-on-year growth of 12 percent. This increase in revenue reflects the company’s successful efforts in attracting tenants and generating income from its commercial properties portfolio.

The growth in both profit and revenue highlights DLF Cyber City Developers’ proficiency in leveraging its real estate assets to generate value and deliver strong financial results. The company’s ability to navigate market dynamics, optimize occupancy rates, and offer attractive commercial spaces has contributed to its positive financial performance.

DLF Cyber City Developers’ achievements in the June quarter of FY24 reflect its strategic vision, operational excellence, and commitment to delivering value to stakeholders. As it continues to manage and develop its commercial properties, the company’s financial performance serves as a testament to its position as a leading player in the real estate sector.

By sustaining growth in profit and revenue, DLF Cyber City Developers is well-positioned to further enhance its presence and contribute to the overall success of the DLF Group. The company’s focus on delivering high-quality commercial properties and creating value for its tenants and investors reaffirms its status as a key player in India’s real estate landscape.