Smooth Sailing: Banks Experience Ease in Exchanging ₹2,000 Notes on Day 1

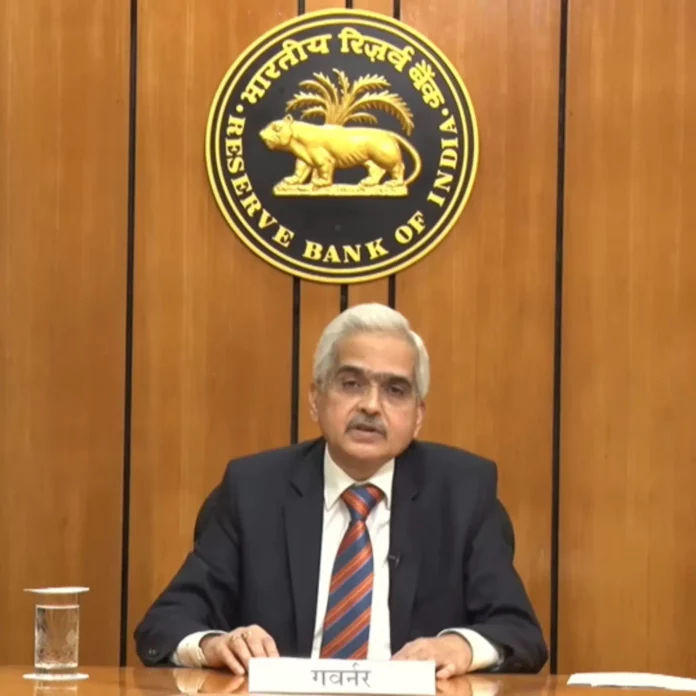

On the first day of the depositing or exchanging of ₹2,000 banknotes, there was a notable absence of long queues or rush at banks across India. While some private banks required customers to provide identity proof, the overall process remained relatively hassle-free. The Reserve Bank of India (RBI) had recently announced the withdrawal of the ₹2,000 denomination notes from circulation, urging individuals to exchange or deposit them by September 30.

In major cities like New Delhi and Kolkata, customers arrived at banks with only a few ₹2,000 notes, resulting in minimal waiting times. However, certain banks refrained from initiating the exchange facility on the first day, citing the absence of clear guidelines from their respective head offices.

In major cities like New Delhi and Kolkata, customers arrived at banks with only a few ₹2,000 notes, resulting in minimal waiting times. However, certain banks refrained from initiating the exchange facility on the first day, citing the absence of clear guidelines from their respective head offices.

An employee at the State Bank of India branch in Kolkata mentioned that there was no significant rush, with only a handful of individuals depositing their ₹2,000 notes, typically not exceeding four or five notes per person. Swapan Kumar Das, a retired government employee, visited a branch in Kolkata to deposit four ₹2,000 notes that he had received in April. For Das, the withdrawal of the denomination provided an opportunity to return the unused notes to the bank.

However, not all customers were able to complete their exchanges smoothly. Some encountered disappointment when they were informed that the exchange facility had not yet been initiated at their respective banks, with only deposits being accepted. The situation varied from one bank to another, as some cashiers initially refused to exchange ₹2,000 notes, while others provided forms and requested customers to submit identity documents such as Aadhaar cards, driving licenses, or voter ID cards.

Overall, the turnout of customers exchanging ₹2,000 notes remained low, surprising bank officials who had anticipated larger crowds. Many banks expressed their willingness to facilitate exchanges for customers as long as they had sufficient cash reserves. However, certain banks adhered strictly to the guidelines set by the Reserve Bank, which included verifying customers’ identification before accepting their notes.

The situation was similar in other cities like Ludhiana and Kanpur, where the number of customers seeking to exchange or deposit ₹2,000 notes remained relatively low. At petrol pumps, however, the demand for fuel using ₹2,000 notes remained high. People were seen opting for smaller amounts of fuel, such as ₹50 or ₹100, and paying with ₹2,000 notes. This resulted in a significant increase in the number of notes received by petrol pump attendants compared to normal days.

In conclusion, the first day of exchanging or depositing ₹2,000 notes at banks witnessed a smooth process, with minimal rush and manageable queues. While some customers faced minor obstacles due to varying bank policies and requirements, Smooth Transition: Banks Effortlessly Handle Exchange of ₹2,000 Notes on Day 1

On the inaugural day of the deposit and exchange facility for ₹2,000 banknotes, the atmosphere at banks in India remained calm and devoid of any significant rush. Despite a few private banks requesting customers to provide identity proof, the overall process proceeded smoothly. The Reserve Bank of India (RBI) had recently declared the withdrawal of ₹2,000 denomination notes from circulation and advised individuals to exchange or deposit them by September 30.

In major cities like New Delhi and Kolkata, customers arrived at banks with only a handful of ₹2,000 notes, resulting in manageable queues and short waiting times. However, a few banks refrained from initiating the exchange facility on the first day, citing the need for clear guidelines from their head offices.

An employee at the State Bank of India branch in Kolkata revealed that the rush was not significant, with only a limited number of people depositing their ₹2,000 notes. Typically, individuals deposited no more than four or five notes each. Swapan Kumar Das, a retired government employee, visited the Kalikapur branch of State Bank of India in Kolkata to deposit four ₹2,000 notes that had been sitting unused in his cupboard since April. Das seized the opportunity presented by the withdrawal of the denomination to return the notes to the bank.

However, not all customers had a smooth experience with their exchanges. Some were disappointed when they learned that their banks had not yet commenced the exchange facility, only accepting deposits. Kakoli Bhadra, a local resident, left the bank disheartened after being informed that only deposits were being accepted at the time.

At the Raja Bazar branch of HDFC Bank in Patna, a cashier initially declined to exchange ₹2,000 notes, citing the absence of guidelines from the head office. Instead, the cashier advised customers to deposit the money into their accounts, stating that the branch had received a total of ₹14,00,000 in ₹2,000 denomination notes. When customers insisted on exchanging their notes, they were provided with a form and requested to present an identity document such as an Aadhaar card, driving license, or voter ID card.

Bank officials expressed surprise at the low turnout of customers seeking to exchange ₹2,000 notes, as they had anticipated larger crowds. Bhupinder Mahal, senior manager of the New Amritsar branch of Punjab National Bank, suggested that the ample time available until September 30 for note exchanges could be a contributing factor to the initial low demand.

In Ambala, Payal, a cashier at a nationalised bank, confirmed that no separate counters had been designated for exchanges, and customers were able to exchange notes at the cash counters. However, she noted that few people had come to exchange their ₹2,000 notes.

Conversely, the HDFC Bank branch on Mall Road in Ludhiana witnessed a long queue at the deposit counter for high-value banknotes. The bank insisted on customers providing identification proof for the transaction.

Meanwhile, a businessman from Ludhiana expressed his frustration when attempting to deposit ₹68,000 worth of ₹2,000 notes. As his Know Your Customer (KYC) verification was still pending, he was instructed to complete a form and submit identification proof for verification before being allowed to deposit the notes. The businessman criticized the process, deeming it burdensome and harassment.

Bank officials assured customers that they were following the guidelines provided by the Reserve Bank. While some banks had anticipated higher footfall, they were prepared to facilitate note exchanges for customers as long as sufficient cash reserves were available. Kirandeep Kaur, a cashier at the Ghumar Mandi branch of State Bank of India, reported that by 1:30 PM, they had assisted 50 customers, each with 10 ₹2,000 notes.

In Punjab, the lower number of customers on Tuesday could be attributed to it being a state holiday commemorating Guru Arjan Dev’s martyrdom day. Bank officials anticipated a higher turnout starting from Wednesday.

In Kanpur, there was no noticeable rush at banks. Visits to three bank branches revealed that only a small number of people, ranging from eight to ten individuals, were present to exchange or deposit ₹2,000 notes. The Shastri Nagar branch of HDFC Bank in Kanpur only accepted ₹2,000 notes after recording the details of each person in a register.

However, petrol pumps throughout the country continued to witness a significant influx of ₹2,000 notes. Customers were observed purchasing smaller amounts of fuel, such as ₹50 or ₹100, and paying with the higher denomination notes. This resulted in a considerable increase in the number of ₹2,000 notes received by petrol pump attendants compared to regular days.

To summarise, the initial day of the deposit and exchange facility for ₹2,000 notes at banks proceeded smoothly, with minimal rush and manageable queues. While some customers encountered minor obstacles due to varying bank policies and requirements,